Why Opening a Business Bank Account Is a Smart Move for Any Entrepreneur

Starting and running a business comes with countless responsibilities and one of the smartest early steps is setting up a business bank account. Not only does a separate account keep your finances organized, but it also builds credibility with clients and vendors while making tax season far less stressful. Whether you’re a freelancer launching a side hustle, a startup founder, or a small business owner ready to grow, choosing the right business bank account online or in-person can shape the future of your financial success. Here’s everything you need to know to make the right choice.

What Makes a Business Bank Account Essential for Small Businesses Today?

For small businesses, keeping personal and professional finances separate isn’t just good practice it’s often legally required. A business bank account for small business operations helps you track expenses, manage revenue streams, and present a professional image to customers and suppliers. Many banks now offer business bank account online free options, catering specifically to startups and entrepreneurs who want fast setup and minimal fees. These accounts often come with helpful tools like invoicing software integrations, mobile check deposits, and cash management services designed to simplify every part of business banking.

Business Bank Account Deals and Bonuses: Are They Worth It?

If you’re searching for the best financial setup, keep an eye out for business bank account deals and promotional offers. Many banks compete for new customers by offering bonuses, waived fees, or even free transfers for a set period. A business bank account bonus could be as simple as earning a few hundred dollars for meeting minimum deposit requirements or maintaining a balance over time. These promotions not only provide a financial boost but also introduce you to premium business banking services that can support your growing operations. Before jumping at an offer, be sure the account’s long-term terms fit your business needs.

How Business Bank Accounts Are Going Fully Digital for Entrepreneurs

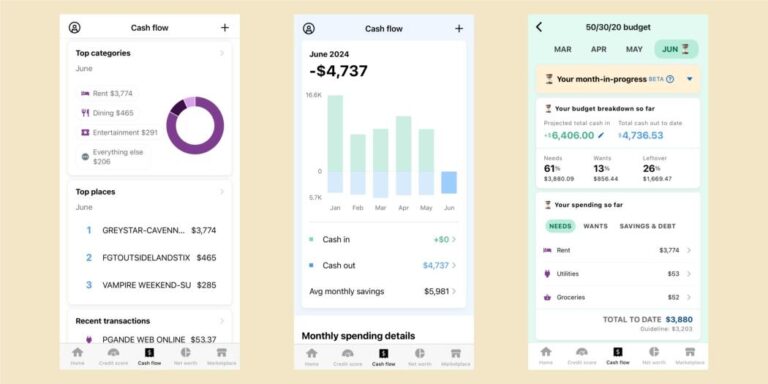

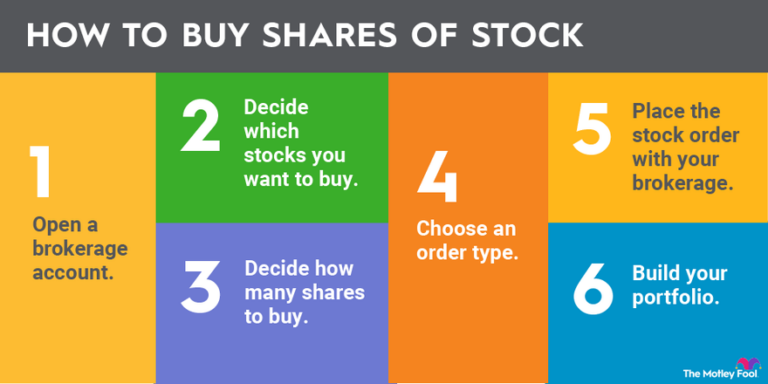

Opening a business bank account online is becoming the norm rather than the exception. Traditional bank visits are being replaced with seamless digital onboarding processes, allowing entrepreneurs to upload documentation, verify identity, and get account numbers sometimes in under an hour. Online business accounts come with unique benefits like better mobile apps, lower fees, and real-time transaction tracking. Especially for freelancers, ecommerce brands, and startups, choosing a business bank account online free or with minimal monthly charges can provide the flexibility to manage your cash flow on the go.

Choosing the Right Business Bank Account: What Really Matters

Not all business accounts are created equal. Before choosing, think about the types of services you’ll need today and tomorrow. Will you need merchant services, wire transfers, or international payment options? How important are customer service and mobile banking features? Does the account offer built-in accounting tools? The right business bank account should grow alongside your company, offering scalable solutions for transactions, savings, credit lines, and beyond. Whether you’re looking for low-cost basic accounts or premium packages loaded with features, matching your needs to the right banking partner can save you time, money, and hassle long-term.

Can I open a business bank account online for free?

Yes, many banks offer free online business accounts with no monthly fees or minimum balance requirements.

What documents are needed to open a business bank account?

You’ll typically need a business license, EIN (Employer Identification Number), and formation documents like LLC agreements or partnership contracts.

Do business bank accounts offer bonuses for new customers?

Yes, many banks offer business bank account bonuses for meeting deposit or transaction requirements within a set timeframe.

Can freelancers and sole proprietors open business bank accounts?

Absolutely. Even if you’re a sole proprietor, having a separate business bank account small business setup is highly recommended.

What is the main benefit of having a separate business bank account?

Separating personal and business finances protects personal assets, simplifies accounting, and strengthens your company’s professional image.

Your business deserves a strong financial foundation. Explore top business bank account options today and take the first step toward easier, smarter money management for your growing brand.