Where To Register A New Company Legally

Ever thought about how many new businesses start every year? Over 4 million new businesses were registered in the US alone in 2021. Choosing where to register your company can significantly impact your business’s success.

Registering a company legally has evolved over time, with some jurisdictions offering more incentives than others. According to the World Bank, New Zealand has been the easiest place to start a business for the past decade. The right location can offer tax benefits, a skilled workforce, and other crucial resources for your startup’s growth.

Where to Register a New Company Legally

Choosing the right location to register your new company is crucial. It can affect your company’s taxes, legal obligations, and overall success. Some countries offer significant benefits for new businesses. Always ensure to research the regulations and laws in each location. This helps you make an informed decision.

In the United States, Delaware is a popular choice for new company registrations. This state offers a favorable legal environment and tax structure. Many corporations choose Delaware for its well-established business laws. You can find detailed information on the state’s official website. Each state has its unique benefits, so it’s worth comparing them.

For those considering an international location, places like Singapore and Ireland are attractive options. They provide business-friendly environments with low corporate taxes. These countries also offer robust support for new businesses. Registration processes in different countries can vary. Ensure you understand the requirements before proceeding.

Below are some key steps to follow when registering a company:

- Determine your business structure (e.g., LLC, corporation)

- Select a state or country for registration

- Register your business name

- Complete necessary forms and submit them to the relevant authorities

- Pay any required fees and obtain your Certificate of Incorporation

Considerations in Choosing the Legal Location for Registration

When selecting a legal location to register your business, taxes play a major role. Some places offer lower tax rates, which can save your business money. For instance, Nevada and Wyoming are known for no state corporate income tax. Not every state or country has the same benefits, though. Carefully compare tax structures before making a decision.

Another important factor to consider is the ease of registration. Some states and countries have straightforward processes, while others might involve complex paperwork. Ensuring a quick and efficient registration process can save you both time and frustration. Checking for any hidden costs related to registration is also wise. Understanding all fees can prevent unexpected expenses.

Your business’s legal requirements can vary greatly depending on the location. Certain states have flexible rules regarding business management and operations. Consider the level of legal support available within the chosen location. Additionally, it’s helpful if the local government supports startups or offers incentives. Such factors can greatly benefit new businesses like yours.

To make the best choice, keep in mind these considerations:

- State or country’s legal climate for businesses

- Local competition and market needs

- Availability of a skilled workforce

- Proximity to your target market

- Quality of infrastructure and services

Benefits of Registering Your Company in Your Home Country

Registering your company in your home country offers significant familiarity and comfort. Understanding local laws and regulations can make the registration process smoother. There’s no language barrier, as all communication and paperwork are in your native language. Additionally, being in a known environment reduces the risk of unexpected legal or cultural complications. This allows you to focus more on growing your business.

Access to local networks and resources can be another big advantage. You often have established contacts who can support your business in various ways. Local banks and investors might also be more willing to offer you financial assistance. Networking events and business associations in your area can provide valuable connections. Taking part in these can aid in building a strong business foundation.

Registering locally can provide easier access to government programs and incentives. Many countries offer grants or tax reductions to encourage local business development. You can also benefit from any government-led business training or mentorship programs. These resources can be crucial for startups seeking guidance and financial support. Being part of your country’s growth story can be rewarding.

Here are some key advantages of registering in your home country:

- Familiar legal system and business practices

- Established local customer base

- Reduced travel costs for day-to-day operations

- Supportive local business environment

- Enhanced credibility with local partners and clients

Benefits of Registering Your Company Overseas

Registering your company overseas can open doors to new markets. Expanding globally allows your business to tap into international customer bases, increasing potential revenue. Different countries often have unique market demands, enabling businesses to diversify their product offerings. This global reach can provide a competitive edge over local-only companies. Moreover, it can enhance your brand’s reputation on an international level.

One of the significant advantages is the potential for favorable tax arrangements. Some countries, like Singapore and Ireland, offer attractive corporate tax rates. These lower rates can lead to significant cost savings for your company. Additionally, certain jurisdictions offer special tax incentives for foreign businesses. This can positively impact your company’s bottom line.

Establishing operations overseas can also lead to access to a skilled workforce. Some countries boast highly educated and skilled labor pools, especially in technology and engineering. Hiring talent from these areas can bring fresh ideas and innovations to your business. It can also lead to cost savings if the labor market is economically favorable. Tapping into diverse viewpoints can foster creativity and growth.

You might also benefit from a more business-friendly regulatory environment. Some countries focus on encouraging foreign investments by simplifying business regulations. This includes less complex procedures for company registration and operation. A supportive legal framework can make it easier to start and run a business smoothly. This can be especially beneficial for startups looking for hassle-free opportunities.

Here are some key benefits of registering overseas:

- Access to new markets and customers

- Potential for lower tax rates and incentives

- Availability of skilled and diverse workforce

- Business-friendly environment and regulations

- Opportunity to build a global brand reputation

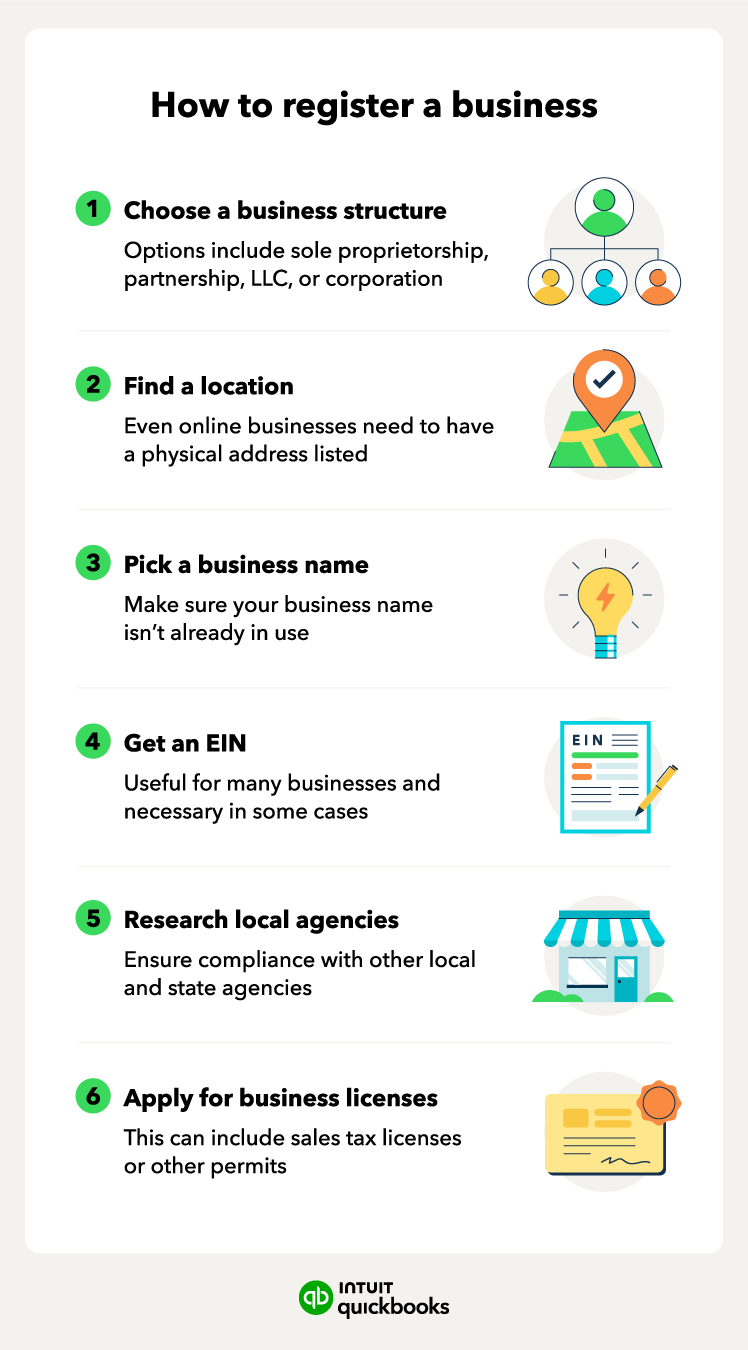

The Legal Process of Registering a Company

The first step in registering a company is choosing the right business structure. You can pick from options like a sole proprietorship, partnership, or corporation. Each structure has different legal implications and tax requirements. Understanding these differences helps you decide what fits your business best. It’s important to research thoroughly before making a choice.

After selecting a business structure, the next step is picking a unique company name. This name must not conflict with any existing business names. You can check available names through your local business registration office or online databases. A unique name distinguishes your company and forms part of its brand. It also ensures legal compliance in most places.

Once you have a name and structure, you move to file the necessary paperwork. This often includes articles of incorporation or organization, depending on your chosen structure. Filing these documents with your local authority officially registers your company. You’ll likely need to pay a small registration fee. This step legally establishes your business as an entity.

After registration, obtaining the appropriate licenses and permits is crucial. The type of business you operate determines what licenses you’ll need. This could include health permits, sales tax permits, or professional licenses. Ensuring you have all the necessary documents helps avoid legal issues in the future. It’s essential for lawful business operations.

The legal process may seem overwhelming, but breaking it into steps makes it manageable.

- Choose a business structure

- Pick a unique company name

- File necessary paperwork

- Pay registration fees

- Obtain licenses and permits

Factors Affecting the Choice of Location for Company Registration

When deciding where to register a company, tax rates play a significant role. Countries or states with lower corporate tax rates can offer substantial savings. Some regions also offer tax incentives specifically designed for startups and small businesses. Researching these opportunities can lead to long-term financial benefits. Being aware of these differences helps in strategic planning.

The local economy is another critical factor. A region with a strong market and healthy economy can support business growth and sustainability. Access to a thriving consumer base can boost sales and profits. Additionally, being in an area with minimal competition might give your company a competitive advantage. These economic factors are essential to consider.

A favorable regulatory environment can make business operations smoother. Some places are known for streamlined processes and less stringent regulations. This can reduce the administrative burden on a company. Easy access to legal assistance and support can further simplify operations. Companies generally prefer regions where the business climate is welcoming.

Availability of a skilled workforce is crucial for any business. Regions with universities and training centers often have a pool of qualified professionals. Hiring skilled employees can lead to innovation and efficiency. Moreover, strong educational facilities indicate an area rich in talent. Assessing workforce availability can hugely impact a company’s performance.

Choosing the right location involves evaluating various factors:

- Tax rates and incentives

- Economic conditions

- Regulatory environment

- Skilled workforce availability

- Market opportunities and competition

Final Thoughts on Company Registration

Registering a company is an essential step that demands careful planning. Whether you choose to register domestically or abroad, understanding the benefits of each option can guide your decision. From tax advantages to workforce access, each factor plays a critical role in the success of your business.

Ultimately, the right location ensures long-term growth and stability. By evaluating regional economic conditions and regulatory environments, you can position your business for success. Making informed choices lays a solid foundation for your company’s future endeavors.