Top Funding Options For New Business Owners

In 2021, startups received a staggering $621 billion in funding, showcasing how the pursuit of fresh capital is crucial for business longevity. But what about those at the very beginning of their entrepreneurial journey? Many new business owners find themselves navigating the maze of funding options with excitement and trepidation alike, wondering which path will not only fuel their dreams but ensure sustainable growth.

Historically, traditional bank loans were the go-to, yet today, options like crowdfunding and angel investors are revolutionizing startup ecosystems. In fact, a 2020 report found that crowdfunding raised over $34 billion globally, highlighting its rising role in young ventures. Understanding these evolving funding pathways is vital as they offer more tailored solutions, catering particularly to niche markets and innovative ideas.

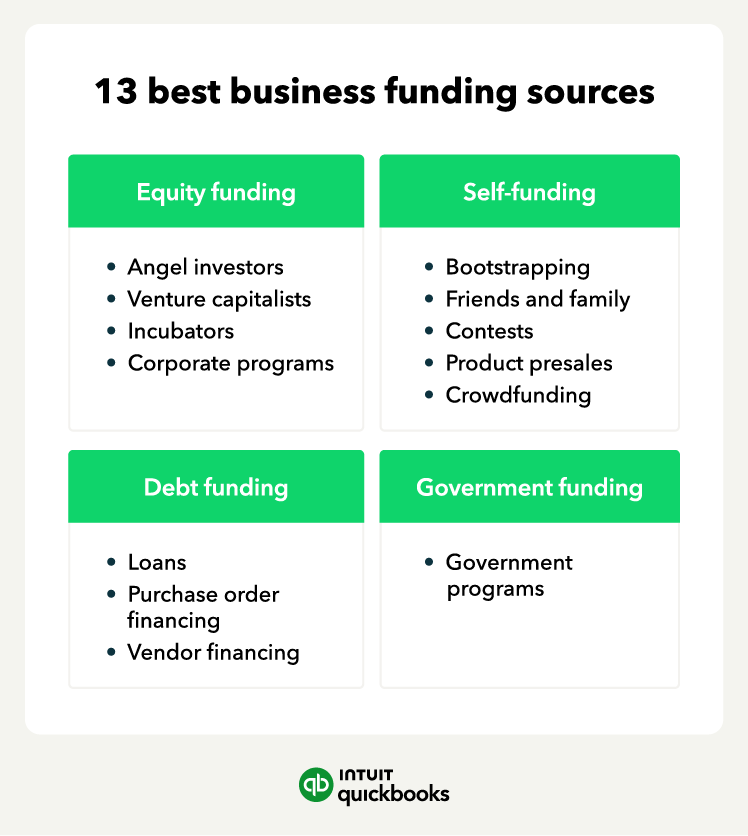

Top funding options for new business owners

New business owners often turn to their personal savings as the first source of funding. It’s common because it’s readily available. However, careful planning is needed to avoid depleting reserves. Besides savings, borrowing from friends and family is popular too. This option can come with less pressure but requires clear terms to avoid misunderstandings.

Crowdfunding has emerged as a trendy method to raise funds. Through platforms like Kickstarter or Indiegogo, entrepreneurs can pitch their ideas to a broad audience. If the idea gains traction, many people can contribute small amounts. This approach not only raises funds but also builds a customer base. Plus, it tests market interest.

Angel investors and venture capitalists are appealing options for many startups. Angel investors often invest in early stages for a share in the company. They bring experience and connections alongside funds. On the other hand, venture capital is more suitable for businesses with significant growth potential. Both options can be highly competitive with rigorous selection processes.

Loans and grants remain stable choices for budding entrepreneurs. Banks offer various loan types, each with specific terms. Meanwhile, government grants don’t require repayment, making them attractive. Applicants must meet specific criteria, though, which can be challenging. It’s crucial to research thoroughly and prepare strong applications.

Personal Savings and Investments

Starting a business using personal savings is a popular choice for many. It’s simple because the money is already yours. There’s no need to pay interest like you would with a loan. You’re also in control of your financial situation, which is empowering. However, using your savings can be risky if things don’t go as planned.

Investing in your business means you’re betting on yourself. It shows confidence in your business idea. Some entrepreneurs even use retirement funds like a 401(k) to get started. This can be smart or risky, depending on your situation. It’s essential to assess whether this strategy fits your long-term financial goals.

Let’s consider the advantages and drawbacks:

- Full control over your business decisions

- No debt obligations

- Potential for financial strain if savings are depleted

- Possibility of losing your safety net

Many experts recommend having a financial backup plan. Keep some savings intact for personal emergencies. Having a secondary income stream can also support you while the business grows. This way, you’re not entirely reliant on immediate success. It’s about balancing current needs with future aspirations.

Borrowing from Friends and Family

Borrowing money from friends and family is a common way to kickstart a new business. It often involves less formalities than bank loans. Trust plays a significant role here, making this option accessible and comfortable. Yet, handling financial matters with loved ones needs care. Without clear communication, it can strain relationships over time.

Setting clear terms is crucial when borrowing from loved ones. You can create a simple agreement to outline repayment terms. This avoids misunderstandings and protects both parties’ interests. It’s important to treat this loan like any other business transaction. Showing respect for their investment builds trust and shows professionalism.

Here are some key points to keep in mind:

- Discuss expectations openly

- Agree on a repayment schedule

- Keep all parties informed of business progress

- Acknowledge their support sincerely

This option allows for flexible funding without high-interest rates. Compared to banks, family loans can offer leniency in times of need. Despite its advantages, having a fallback plan is wise. Ensure you have other strategies in place if your business faces hardships. Balancing your financial obligations maintains healthy personal relationships.

Crowdfunding

Crowdfunding is a modern way to gather funds from many people, usually through the internet. Platforms like Kickstarter and Indiegogo make this process easy. Entrepreneurs present their ideas online, and people interested in their projects can contribute money. This method allows for a wide reach, tapping into a global audience. It’s not just about raising money but also about building a community around your idea.

To succeed in crowdfunding, a compelling story is key. People need to connect with your mission. Visual elements like videos and images help showcase your passion and detail the product or service. Transparent updates about the project’s progress keep backers engaged. Honesty and open communication are fundamental in maintaining trust.

Crowdfunding comes with its challenges, though. It requires significant planning and effort upfront to create appealing campaigns. Crafting a successful campaign can be time-consuming. It also has no guarantee of success if the goal isn’t reached, often resulting in no funds received. Additionally, fulfilling promises to backers is crucial to safeguard your reputation.

Consider these strategies to enhance your campaign:

- Research successful past campaigns

- Engage with your audience through social media

- Offer enticing rewards for backers

- Set a realistic funding goal

The crowdfunding trend continues to grow, providing small businesses with a chance to shine without traditional financing. It’s revolutionizing how startups launch. For those with innovative ideas and committed followers, this is a practical path. However, it’s essential to approach it with a well-thought-out plan to truly leverage its potential.

Angel Investors and Venture Capitalists

Angel investors are individuals who provide capital for startups in exchange for equity. They typically invest their own money and may offer mentorship and advice. This funding option is ideal for early-stage companies needing substantial funds to grow. Angels can bring valuable industry connections. Having an angel investor can boost credibility for your business.

Venture capitalists operate differently. They manage pooled funds from many investors to fund high-growth startups. Venture capital firms often seek significant equity stakes, aiming for substantial returns. This type of funding is generally suited for businesses with strong potential for rapid expansion. Achieving venture capital investment often involves a rigorous selection process.

- Benefits of Angel Investors:

- Personal investment from wealth individuals

- Mentorship and networking opportunities

- Suitability for early-stage startups

- Benefits of Venture Capitalists:

- Larger investment amounts

- Support from established firms

- Focused on high-growth companies

Challenges exist for both options. Angel investors may exert significant influence over your business decisions. Venture capitalists expect rapid growth and can be demanding. It’s essential to align your business goals with the investor’s expectations. Thorough research and due diligence can help find the best fit.

Preparing a strong pitch is essential when seeking these types of funding. Highlight your business’s growth potential and market opportunity. Be transparent about financial projections and how the investment will be used. Engaging narratively in your pitch can capture the interest of investors. Success hinges on clear communication and compelling proof of your business’s potential.

Loans and Grants from Financial Institutions

Loans from financial institutions are a traditional way to fund a new business. Banks offer various loan types, such as term loans and lines of credit. Each loan type comes with its own set of terms and repayment schedules. This option usually requires a solid business plan and good credit history. Securing a loan can give your business the funds needed for initial operations and growth.

Grants, on the other hand, provide money that does not need to be repaid. They are often offered by government agencies and nonprofit organizations. The application process can be competitive and detailed. Successfully securing a grant means you have shown that your business aligns with the goals of the granting organization. This funding can be a significant financial boost without the burden of debt.

Here are some pros and cons of loans and grants:

- Loans:

- Provides immediate funds

- Requires repayment with interest

- Accessible with good credit and a business plan

- Grants:

- No repayment needed

- Highly competitive

- May have specific usage requirements

Choosing between loans and grants depends on your business needs and situation. Loans are faster to obtain but carry the obligation of repayment. Grants, though harder to secure, provide free money that can help immensely. It’s wise to consider both options when planning your business financing. Exploring multiple avenues increases your chances of finding the right funding source.

Financial institutions may also offer advice and resources to help you succeed. Building a relationship with your bank can be beneficial. They can provide guidance on managing funds and meeting financial goals. Utilizing these resources can enhance your business’s financial stability. Make sure to explore all the services your financial institution offers.

The role of startups accelerators and incubators

Startup accelerators and incubators play a vital role in helping new businesses grow. They offer resources, mentorship, and funding opportunities. Accelerators focus on rapid growth, often with structured programs that last a few months. Incubators usually provide a longer-term nurturing environment. Both environments aim to prepare startups for scalability and success.

Participating in an accelerator program can boost a startup’s chance of gaining investors. These programs are typically time-bound and intensive, requiring dedication from entrepreneurs. They help refine business models, develop products, and build networks of contacts. Access to experienced mentors is another significant advantage of being in an accelerator. This guidance can ensure that the business moves in the right direction.

Incubators offer more flexible timelines compared to accelerators. This setting is suitable for startups still in the early stages of development. Participants receive access to office space, equipment, and shared resources like legal or marketing advice. The incubation period allows startups to experiment without heavy financial pressure. It creates a safe space for budding ideas to evolve into viable products or services.

- Benefits of Startup Accelerators:

- Rapid growth focus

- Structured mentorship

- Enhanced networking prospects

- Pros of Using Incubators:

- Access to essential resources

- Aids slower-paced development

- Nurturing community support

The decision between an accelerator or incubator depends on a startup’s goals and stage of development. Evaluating which environment aligns better with your objectives is key. Some businesses may even participate in both at different points in their journey. These programs offer invaluable support for emerging companies looking to solidify their presence in the market. Utilizing such opportunities can create pathways to long-term success.

Navigating government funding programs

Government funding programs are a crucial resource for new business owners. These initiatives aim to boost growth and innovation. Understanding how to access this funding can be a game-changer. There are numerous grants and loans available for startups. Each program typically targets specific sectors or business types.

Researching these programs begins with identifying relevant opportunities suited to your business. Many government websites offer detailed information and guidance. It’s essential to follow their application procedures carefully. Missing required documents can delay or even disqualify an application. Preparing thoroughly increases the odds of success.

- Steps to Navigate Government Funding:

- Identify suitable programs for your industry

- Prepare necessary documentation

- Follow all application guidelines

- Submit applications before deadlines

Working with local government offices or small business centers can provide extra assistance. They often have experts available to answer questions. These experts can offer insights into the application process. It’s valuable to tap into their networks and resources for additional support. Building connections can further enhance your chances of securing funding.

Some businesses might think about hiring a grant writer. These professionals specialize in crafting compelling applications. They can highlight your business’s strengths effectively. Deciding to bring one into your team might increase your expenses, but it could make a big difference in successfully securing grants. Weighing this option carefully is an important part of the decision-making process.

Pros and cons of each funding option

Understanding the advantages and disadvantages of each funding option is crucial for new business owners. Different types of funding suit different business needs. Let’s explore these variations. This information can guide you in making well-informed decisions. It ensures you choose the right path for your startup.

| Funding Option | Pros | Cons |

|---|---|---|

| Personal Savings | No debt, full control, quick access | Risk of depleting personal funds, no financial backup |

| Friends and Family | Flexible, low or no interest, personal support | Potential for strained relationships, unclear terms |

| Crowdfunding | Wide reach, builds community and customer base | Requires significant promotion, all-or-nothing funding |

| Angel Investors | Mentorship, significant funds, industry connections | Equity loss, investor influence on business decisions |

| Venture Capital | Large investments, support from firms | Equity stakes, pressure for rapid growth |

| Loans | Immediate funds, structured repayment | Interest payments, good credit required |

| Grants | No repayment, financial boost | Highly competitive, specific usage requirements |

Personal savings offer quick access and full control but come with the risk of running out of money. Borrowing from friends and family is flexible and usually low-cost but can lead to strained relationships. Crowdfunding helps gather a community around your business, requiring a lot of promotion and effort. While it builds a customer base, it often demands a successful pitch and extensive marketing.

Angel investors bring substantial funds and mentorship, but they also take equity in your company. Venture capital offers considerable investment amounts, pushing for quick growth and high returns. This can create strong pressure on the business. Loans provide instant access to money but require good credit and have interest payments. Grants are competitive and specific in their usage but offer a large financial boost without the need to repay.

Choosing the right funding option for your startup

Deciding on the best funding option for your startup involves considering several factors. It’s crucial to align the choice with your business goals. The stage of your business can heavily influence which option suits you best. Each funding type caters to different needs and scenarios. Evaluating these can lead to long-term business success.

Start by assessing the amount of capital needed. Larger funding may be required for ambitious initiatives, making venture capital a viable option. For smaller needs or early-stage ideas, personal savings or funding from friends might suffice. Having a clear idea of your financial requirements is the first step. It guides you in prioritizing the available options.

Your startup’s growth potential and timeline also play significant roles. A fast-growing tech startup might benefit from accelerator programs and angel investors. If you anticipate a slower growth trajectory, incubators and grants can offer the patience needed. Assessing these aspects helps in aligning your expectations with the appropriate funding channels.

Making a list of potential pros and cons for each option can clarify your decision. Consider aspects like equity, control, repayment terms, and the level of support required. Determining what trade-offs you’re willing to make can narrow down choices. A comprehensive list allows for a clearer comparison.

- Questions to consider:

- How urgent is your funding need?

- Are you willing to share equity?

- Do you need mentoring and resources?

- What is your risk tolerance?

Exploring diverse funding sources strengthens your financing strategy. Diversifying with a mix of funding types is sometimes beneficial. It reduces reliance on a single source. Combining personal funds with grants or small loans spreads the risk. This mix may offer the best security for evolving business needs.

Final Thoughts on Funding Options

Choosing the right funding strategy is crucial for the success of your startup. Each option presents unique benefits and potential drawbacks. Balancing personal goals with financial realities ensures informed decision-making. Entrepreneurs must remain flexible and open to adapting their strategies as their businesses evolve.

In the dynamic landscape of startups, staying informed is vital. By understanding various funding opportunities, you empower your venture to thrive. Remember, the right mix of resources and guidance sets the foundation for sustainable growth. With careful planning and the right choices, your startup can soar to new heights.