Retirement Finance Planning Checklist: A Guide to Securing Your Future

Planning for retirement is one of the most important financial steps you’ll take in your lifetime. A solid retirement plan ensures that you have enough funds to live comfortably once you stop working. However, without proper planning, it can be easy to overlook crucial elements that could impact your future. A retirement finance planning checklist helps guide you through the process, ensuring that you cover all the necessary steps. Whether you’re just starting to save or nearing retirement, this checklist will provide the clarity you need to secure your financial future.

Start Early: The Power of Compound Interest

One of the key components of successful retirement planning is starting early. The earlier you begin saving, the more time your investments have to grow. Compound interest works to your advantage when you invest over a long period, which is why it’s important to begin building your retirement fund as soon as possible. Even small contributions early in your career can grow significantly by the time you retire. Don’t wait until it’s too late starting today gives you a financial advantage that will pay off in the long run.

Set Realistic Retirement Goals

Setting specific, measurable, and realistic retirement goals is essential to your financial planning. First, determine when you’d like to retire and what kind of lifestyle you envision. Do you plan to travel, live in a certain area, or pursue hobbies? This will affect how much money you’ll need to save. By clearly defining your goals, you can break down how much you need to save each year to reach them. Remember, your retirement goals will evolve over time, so revisiting and adjusting them periodically will keep you on track.

Create a Budget for Retirement Savings

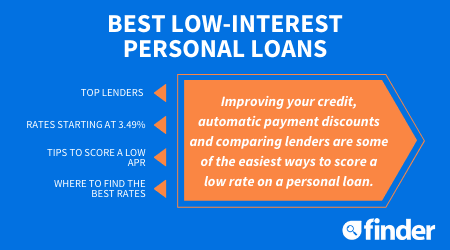

Budgeting is a critical part of any financial plan. To ensure that you’re putting aside enough for retirement, it’s important to review your income and expenses regularly. By creating a budget that allocates a percentage of your income to retirement savings, you can avoid overspending and stay focused on your financial goals. Retirement planning tools, such as automatic contributions to retirement accounts, can help you stay disciplined and ensure that your savings grow steadily.

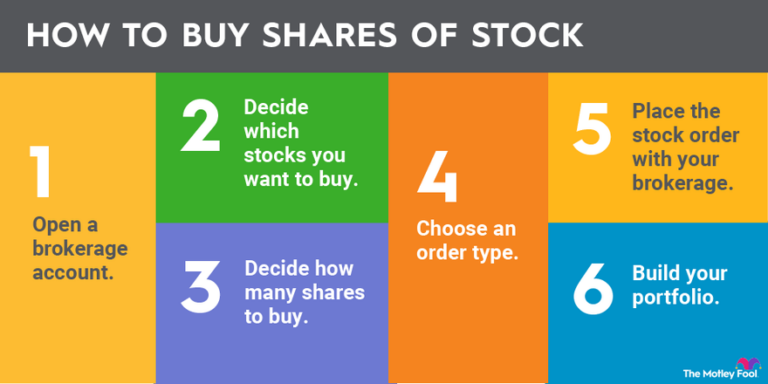

Diversify Your Retirement Investments

Diversification is key when it comes to investing for retirement. Depending solely on one investment vehicle—such as a 401(k) or individual retirement account (IRA) can expose you to unnecessary risks. Consider diversifying across different asset classes, such as stocks, bonds, mutual funds, and real estate. Each investment type offers a unique risk-return profile, and diversifying can help mitigate potential losses. Additionally, review your asset allocation periodically to ensure it aligns with your risk tolerance and retirement timeline.

Plan for Healthcare and Unexpected Expenses

As you approach retirement, healthcare and other unexpected expenses become increasingly important. Medicare covers a significant portion of healthcare costs for retirees, but it doesn’t cover everything. You may need to budget for supplemental health insurance, long-term care, or out-of-pocket medical expenses. Setting aside extra funds for these potential costs is an essential part of your retirement planning. Additionally, building an emergency fund can help protect your retirement savings from unforeseen events.

FAQs

- When should I start planning for retirement? The earlier you start, the better. Ideally, begin as soon as possible to take advantage of compound interest.

- How much should I save for retirement each year? It depends on your retirement goals and current income, but financial experts recommend saving at least 15% of your annual income for retirement.

- What are the best investment options for retirement savings? Diversify your retirement savings across stocks, bonds, mutual funds, and real estate to manage risk while aiming for growth.

- What happens if I don’t save enough for retirement? Not saving enough for retirement can result in financial difficulties in your later years, forcing you to rely on limited savings or even Social Security benefits.

- How can I calculate how much I’ll need for retirement? Estimate your desired retirement lifestyle, including living expenses, travel, and healthcare costs, and work backward to determine how much you need to save.