Local Financial Advisors Near Me

The world of finance often seems like a grand chess game, teetering between risks and rewards. When local financial advisors step in, they bring not just expertise but a profound understanding of the community’s unique financial landscape. They tailor strategies with precision, ensuring their clients are equipped to navigate the complex financial terrain confidently.

Interestingly, the concept of localized financial advising has deep roots dating back to neighborhood gatherings around kitchen tables. Today, statistics reveal that employing local advisors can result in an average of 20% higher client satisfaction compared to their online counterparts. They offer a personalized touch, melding professional financial guidance with a nuanced, localized approach that simply can’t be replicated online. This history reinforces the timeless value of personal expertise rooted in local knowledge.

Benefits of Choosing a Local Financial Advisor

Local financial advisors have a unique understanding of the community they serve. They know the local economy, which helps them craft tailored financial plans. Their knowledge of local financial trends can provide insights that outsider advisors might miss. Moreover, clients often feel more comfortable meeting face-to-face with someone familiar. This trust can lead to better communication and tailored financial goals.

Choosing a local advisor also means supporting community businesses. When you work with someone local, your investment often stays within the community. This strengthens local economic growth and creates a network of trust. Additionally, local advisors can offer insights into local real estate or business opportunities. Their expertise can be invaluable for making smart, community-focused investments.

Local financial advisors personalize the experience. They often take extra time to understand each client’s goals. This personalized approach can lead to better financial outcomes.

- Customized investment strategies

- Adaptable financial planning

- Access to local opportunities

These benefits make choosing a local advisor a smart choice for many people.

The accessibility of local advisors is another significant advantage. Clients can arrange quick meetings or check-ins when needed. This proximity means more timely advice, keeping financial plans on track. Plus, local advisors often have established relationships with local banks and lenders. These connections can ease the process of securing loans or other financial services.

Personalized Financial Strategies Tailored to Local Economic Conditions

When it comes to financial planning, one size doesn’t fit all. Local financial advisors understand the specific conditions of the area where you live. This understanding allows them to create personalized financial strategies that resonate with local economic trends. By aligning investment choices with regional opportunities, advisors can enhance financial stability for their clients. Such strategies often result in better long-term outcomes.

Local advisors can identify growth sectors within the local economy. They may recommend investing in certain industries or real estate developments that are thriving. These recommendations are based on their firsthand knowledge of the local market.

- Boosting potential returns

- Reducing investment risks

- Adapting to economic changes

These strategies aim to align with both personal goals and economic shifts.

Community-centric approaches strengthen client-advisor relationships. When advisors focus on local conditions, they cater to clients’ specific needs. This personal touch is invaluable and builds trust over time. Clients are often more willing to discuss future plans and potential challenges. These open conversations can lead to more effective financial planning.

Financial strategies shaped by local factors offer distinct advantages. Advisors can adjust plans quickly in response to sudden economic changes. Clients benefit from timely advice, keeping them prepared for financial shifts. By focusing on local economic conditions, advisors help clients thrive even during uncertain times. This localized attention ensures a more secure financial future for those they serve.

Key Services Offered by Local Financial Advisors

Local financial advisors provide a wide range of services that cater to individuals and families. One of their primary services is investment planning, where they help clients grow their wealth over time. They assess risk tolerance and financial goals to create tailored investment portfolios. Advisors also offer retirement planning, ensuring that clients can enjoy a stress-free retirement. This involves strategies like 401(k) setups and IRA management.

Another essential service is tax planning, which involves crafting strategies to minimize tax liabilities. Advisors work with clients to maximize deductions and plan for tax-efficient investments.

- Reducing overall tax burden

- Year-round tax planning

- Adapting to tax law changes

With these services, clients can keep more of their hard-earned money. This proactive approach prepares individuals for any financial surprises during tax season.

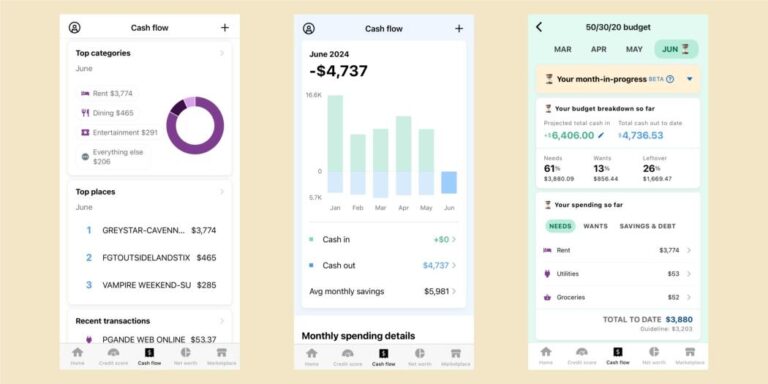

Budgeting and debt management are also crucial services offered by local advisors. They assist clients in creating realistic budgets that align with their income levels. By setting spending limits and identifying areas for savings, clients can achieve financial balance. Advisors help manage and reduce debt through effective repayment plans. This service is vital for those struggling with loans and credit card debt.

Estate planning rounds out the key services provided by financial advisors. By guiding clients through the process of creating wills and trusts, they ensure assets are protected and distributed according to their wishes. This planning secures financial futures for loved ones, giving peace of mind. Local advisors also offer insights into local laws affecting estate decisions. Combining these services, they provide comprehensive support for a secure financial future.

How to Find the Right Local Financial Advisor for Your Needs

Beginning your search for a local financial advisor can be overwhelming, but knowing your needs is the first step. Identify the specific services you require, such as retirement planning or tax advice. This clarity helps narrow down potential advisors who specialize in those areas. Do some research to gather a list of advisors nearby. Recommendations from friends or family can be valuable when compiling this list.

Check each advisor’s credentials and experience. A reliable financial advisor should have the proper certifications, like a Certified Financial Planner (CFP) designation. Experience in the industry and positive client reviews are also important. Make sure to look at their background and ask for testimonials if available. This step ensures you choose someone who is both qualified and trustworthy.

Meet potential advisors in person to assess their approach and communication style. Initial consultations, usually offered for free, can provide insights into their strategies. These meetings allow you to ask questions and determine if the advisor aligns with your goals. Communication is key in the advisor-client relationship. A good advisor should be someone who makes you feel comfortable and heard.

Compare the fees and costs associated with each advisor. Some may charge a flat fee, while others earn a commission based on investments. Understanding these fee structures is vital to avoid unexpected expenses.

- Flat fees for consultations

- Commission-based on investment percentages

- Hourly rates for specific services

Choosing an advisor with transparent pricing can help maintain a healthy financial relationship.

Lastly, consider the advisor’s availability and responsiveness. Find out how often they are willing to meet or communicate. Whether through phone calls, emails, or face-to-face meetings, ensure they are accessible. Accessibility plays a crucial role when urgent financial decisions arise. A responsive advisor can offer peace of mind and timely advice as needed.

Understanding the Qualifications and Certifications of Trusted Advisors

When looking for a financial advisor, qualifications and certifications matter the most. A reputable advisor often holds certifications that showcase their expertise and dedication. One key certification is the Certified Financial Planner (CFP) credential. This certification requires rigorous training and exams. It signifies that the advisor has met the necessary standards in financial planning and ethics.

Another important qualification is the Chartered Financial Analyst (CFA) designation. CFAs have in-depth knowledge of investment management and asset allocation. This certification is highly respected in the finance industry.

- Investment management expertise

- Rigorous training

- Global recognition

Working with a CFA can be beneficial for clients who need specialized investment advice.

Besides CFP and CFA, there are other relevant certifications like the Certified Public Accountant (CPA). CPAs are experts in accounting and tax planning. They are licensed and regulated by state boards, ensuring high standards of practice. Their skills are invaluable during tax season and for detailed financial planning. An advisor with a CPA designation can help you navigate complex tax scenarios efficiently.

Moreover, advisors might hold the Personal Financial Specialist (PFS) certification. This certification is for CPAs who have further specialized in financial planning. It combines the rigorous accounting expertise of a CPA with advanced financial planning skills.

| Certification | Focus Area |

|---|---|

| CFP | General financial planning |

| CFA | Investment management |

| CPA | Tax planning |

| PFS | Advanced financial planning |

Choosing an advisor with such credentials ensures comprehensive and trustworthy financial guidance.

Lastly, always verify the validity of an advisor’s certifications. Check their status and any disciplinary history through regulatory bodies. This step adds an extra layer of security to your selection process. Ensuring an advisor’s credibility helps build a trustworthy financial partnership. This transparency fosters confidence in the advisor’s ability to manage your financial future effectively.

Real-Life Success Stories: Building Financial Health with Local Experts

One story comes from a family struggling with mounting debt. They turned to a local financial advisor who specialized in debt management. The advisor crafted a personalized budget, helping them prioritize debt repayment. Within a year, they paid off credit cards and started saving for emergencies. This transformation lifted a huge weight off their shoulders.

Another inspiring case involves a young entrepreneur. With a great idea but no financial plan, she sought advice from a local expert. The advisor provided guidance on securing small business loans and managing cash flow.

- Strategic financial guidance

- Loan acquisition advice

- Optimized cash management

Her business thrived as she learned to balance expenses and investments wisely.

A retired couple is yet another success story. They were anxious about their savings lasting through retirement. A local advisor reviewed their assets and suggested smart investment options. Thanks to diversified investments, they now enjoy traveling while maintaining financial security. Their trust in a local expert made their golden years truly golden.

Small businesses have also benefited from local advisory. One such business faced sudden economic downturns but was guided through with innovative financial strategies. The advisor helped reallocate resources and cut unnecessary expenses.

| Challenge | Solution |

|---|---|

| High overhead costs | Resource reallocation |

| Low cash reserves | Emergency fund strategy |

| Declining sales | Cost-cutting measures |

These strategies not only saved the business but allowed it to expand further.

Lastly, a single parent approached a trusted local advisor seeking financial relief. The advisor provided crucial advice on educational savings plans and budget management. With this guidance, the parent started a college fund for their child while maintaining everyday expenses. This peace of mind allowed them to focus on what truly mattered: providing a bright future for their family. Local expertise made that possible, emphasizing the value of community-focused financial planning.

Conclusion

Local financial advisors play a pivotal role in enhancing financial health through personalized strategies and community knowledge. Their ability to craft tailored plans, while considering local economic conditions, sets them apart from broader financial services. These trusted experts empower clients by providing targeted advice and building lasting financial confidence. Investing in local expertise is an investment in a secure financial future.

The success of real-life stories speaks volumes about the impactful guidance provided by local advisors. From resolving debt to securing retirement, their strategies offer a lifeline in various scenarios. As financial landscapes evolve, having a grounded, expert partner ensures you’re always ready for the journey ahead. Choosing a local financial advisor isn’t just a decision; it’s a step towards resilient financial well-being.