How To Register An Online Business Legally

Registering an online business might seem like a daunting task, but it can be a rewarding venture if done right. Ever wondered how your favorite online store got its start? The legal norms and nuances can unravel paths to global success when correctly navigated. Let’s explore the essentials that ensure your business isn’t lost in the digital ether.

Understanding the foundations of launching an online business begins with choosing the right business structure. Historically, the limited liability company (LLC) has been favored due to its flexibility. Did you know that according to recent statistics, over 70% of new businesses opt for an LLC? Once chosen, the next step involves registering your business name and acquiring any necessary licenses. Keeping abreast of these steps ensures a smooth foreground for your online enterprise.

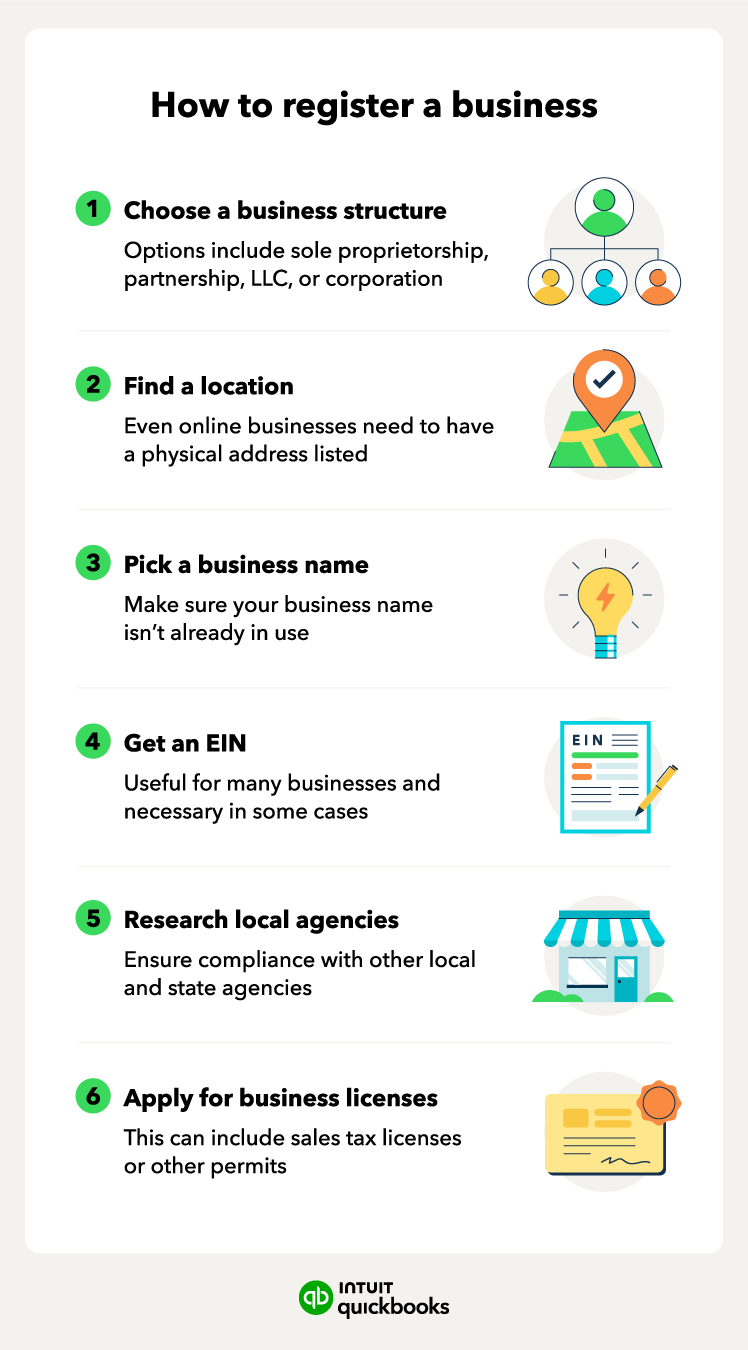

How to Register an Online Business Legally

Registering your online business legally is an essential step for success. First, pick the right business structure that fits your needs. Many choose a Limited Liability Company (LLC) for flexibility and protection. Once you decide, you’ll need to register your business name. This name becomes your brand’s identity and must be unique to avoid any legal disputes.

Next, it’s crucial to check for necessary licenses and permits. These vary depending on your business type and location. Research local and state requirements to stay compliant. Ignoring this step can lead to fines or business closure. By doing this, you ensure a solid legal foundation for your business.

Obtaining an Employer Identification Number (EIN) might also be necessary. This number is like a Social Security number for your business. It helps with opening a bank account and filing taxes. Most businesses get an EIN through the IRS website. It’s a fast and easy process that sets you up for future financial needs.

Lastly, consider opening a business bank account. Keeping business and personal finances separate is wise. A separate account makes tracking expenses and managing cash flow easier. Plus, it’s a strong signal of professionalism to clients and partners. A well-structured setup paves the way for growth and credibility.

Step 1: Selecting Your Business Structure

Choosing the right business structure is like picking the foundation for your house. This decision affects your taxes, liability, and how easy it is to get funds. The main types to consider include Sole Proprietorship, Partnership, and Limited Liability Company (LLC). A Sole Proprietorship can be perfect if you’re starting solo. However, it offers less personal protection against debts.

If you’re planning to team up with someone, a Partnership might suit you best. In this setup, you share profits, losses, and responsibilities. Both partners have a say in how the business runs. Nevertheless, remember that personal assets might be at risk if things go awry. Therefore, having a clear partnership agreement is crucial.

An LLC often combines the best of both worlds. It provides personal liability protection while keeping tax benefits. Here’s a quick look at how these structures differ:

| Structure | Liability | Taxation |

|---|---|---|

| Sole Proprietorship | Unlimited | Personal tax rate |

| Partnership | Unlimited | Shared among partners |

| LLC | Limited | Possible pass-through |

Consider your long-term business goals when making this decision. If expansion is in your plans, an LLC or even a Corporation might be better. Being informed and thoughtful now can save you legal headaches later. Whichever path you choose, ensure it aligns with your vision and needs. Tailoring your choice to your business goals sets the groundwork for success.

Step 2: Registering Your Business Name

Registering your business name is a vital step in establishing your brand. The name you choose will stick with your business for a long time, acting as its identity. It should be unique, relatable, and memorable. To start, think of a few names you like. Then, check if they’re available by searching online business name registries.

Once you find a name that isn’t taken, you’ll need to register it officially. This process varies based on your location and chosen business structure. If you’re running a Sole Proprietorship or Partnership, you might need a “Doing Business As” (DBA) registration. This allows you to operate under a trade name rather than your own. Corporations and LLCs usually register their names during the formation process.

Ensuring your business name is unique is important to avoid legal issues. You don’t want another company claiming your name is too similar to theirs. Here’s a simple checklist to verify your name:

- Check domain name availability for your website.

- Search trademark databases to avoid conflicts.

- Ensure social media handles are available.

Taking these steps early on can save you future headaches. A well-chosen name also helps with branding and attracting customers. Ensure it’s reflected everywhere, from business cards to webpages. Make it a name that leaves a lasting impression. Finally, celebrate—your business now has an official name!

Step 3: Obtaining Legal Licenses and Permits

Obtaining the necessary legal licenses and permits is a crucial step for any business. Depending on your location and type of business, the requirements can vary widely. It’s important to research local, state, and federal regulations. Some businesses might need general licenses, while others may require specific permits, such as health or safety licenses. Ensuring you have the correct ones can save you from fines and legal issues down the road.

Starting with a general business license is a good idea. This license gives you the legal right to operate your business in a particular area. Check with your local government office to understand the application process. Often, the requirements and fees will be specified on their website. Having this license helps in establishing your business as legitimate and trustworthy.

If your business involves food, health, or safety, additional permits might be needed. Restaurants, for example, typically need health department permits. Construction businesses may need safety and environmental permits. Each industry has its specific regulations, so it’s essential to know what applies to you. Consulting an expert or a business bureau can provide clarity.

Here’s a quick overview of common licenses and permits:

- General Business License

- Health and Safety Permits

- Sales Tax License

- Professional Licenses (e.g., for doctors or lawyers)

- Environmental Permits

Understanding and obtaining these licenses can seem overwhelming. However, it ensures your business operates within the legal framework. Record keeping is important; keep copies of all your licenses and permits. Having them organized and accessible can be very helpful during inspections or audits. Ultimately, being thorough now will create a smoother path for your business operations.

Stay updated on renewals and any regulatory changes. Licenses often have to be renewed annually or biannually. Missing a renewal can result in penalties or business interruptions. Some industries also face frequent changes in regulations, so staying informed is key. Regularly check with local authorities to ensure you remain compliant.

Benefits of Registering Your Online Business

Registering your online business offers numerous advantages that boost credibility and growth. One key benefit is legal protection. When registered, your business becomes a separate legal entity. This means your personal assets are protected if the business faces financial issues. It provides a safety net that can give you peace of mind.

Another significant benefit is the ability to attract customers and partners. A registered business appears more professional and trustworthy. Customers feel safer knowing they are dealing with a legitimate entity. It also opens doors to partnership opportunities that can help expand your business. You can even join business directories, enhancing your visibility.

Financial benefits are also a major perk. Registered businesses can apply for loans, grants, and credit lines. These financial resources can be vital for growth, especially in the early stages. Additionally, registering your business can offer tax benefits. You may be able to deduct business expenses, lowering your overall tax burden.

Registering your business also helps with brand protection. Once registered, your business name is legally protected from being used by others. This safeguards your brand identity and ensures customers won’t be confused by similar names. Here’s a simple table summarizing the benefits:

| Benefit | Description |

|---|---|

| Legal Protection | Personal assets are safeguarded |

| Professional Image | Appears trustworthy to customers and partners |

| Financial Opportunities | Access to loans and tax benefits |

| Brand Protection | Unique business name is secured |

Lastly, a registered business can easily scale and adapt. Whether you’re planning to hire employees, open new locations, or offer new products, being registered makes the process smoother. You’re able to meet regulatory requirements more easily. Overall, registration lays a solid foundation for long-term success and stability.

Potential Issues with Unregistered Businesses Online

Running an unregistered business online can lead to various complications. One major issue is the lack of legal protection. Without registration, your personal assets can be at risk if your business is sued. You could lose your home, car, or savings. This risk makes it essential to consider registering your business.

Another problem is credibility. Customers are more hesitant to trust a business that isn’t registered. They might worry about scams or fraudulent activities. Not being registered can also prevent you from building strong partnerships. Most companies prefer working with registered entities to avoid legal troubles.

Unregistered businesses may face financial obstacles as well. You can’t easily apply for business loans or credit lines. Banks and investors require registration information to assess your credibility. Additionally, without a proper business structure, you might miss out on tax benefits. Government grants and subsidies are also out of reach for unregistered businesses.

Not registering your business can also lead to legal penalties. Operating without the necessary licenses and permits can result in hefty fines. In some cases, you might even face legal action that could shut down your business. Staying compliant with local and federal regulations helps avoid these issues. Here’s a quick overview:

| Issue | Impact |

|---|---|

| Lack of Legal Protection | Personal assets at risk |

| Credibility Issues | Loss of customer trust |

| Financial Obstacles | Limited access to funds |

| Legal Penalties | Fines and potential shutdown |

Lastly, unregistered businesses struggle with growth and scalability. Expanding your business or hiring employees can be difficult without registration documents. You may face challenges in meeting regulatory requirements. Registering your business sets the groundwork for future expansion. It provides the necessary structure and legitimacy to attract both customers and partners.

Final Thoughts on Registering Your Online Business

Registering your online business opens up a world of opportunities. It safeguards your personal assets while establishing credibility. This step lays a robust foundation, enabling you to access financial resources and expand your enterprise. As you navigate the complexities of the digital market, a registered business status builds trust with customers and partners alike.

Neglecting to register can lead to significant hurdles. Unregistered businesses risk credibility and legal challenges that can stifle growth. By understanding the benefits and avoiding potential pitfalls, you position your business for long-term success. Taking this crucial step ensures sustainability and paves the way for exciting future prospects.