How To Get Funding For An Online Business

Launching an online business can be both exciting and daunting, especially when 82% of small businesses fail due to cash flow problems. This statistic highlights the critical need for effective funding strategies. Securing the right funding can transform an innovative idea into a thriving digital enterprise.

Modern funding options have evolved significantly, reflecting the dynamic nature of online commerce. Crowdfunding has become a game-changer, with platforms raising billions annually for startups across the globe. Furthermore, exploring venture capital or angel investors could provide not only financial support but also invaluable expertise and networking opportunities.

How to get funding for an online business

Securing funding for an online business can seem like a big challenge. One place to start is by determining your specific funding needs. This means figuring out how much money you need to get your business off the ground. Create a detailed list of all startup costs such as technology, marketing, and inventory. Knowing this number will help you look for the right kind of funding.

Once you’ve figured out your funding needs, it’s essential to prepare a solid business plan. A business plan should include your business goals, target market, and marketing strategies. It shows potential investors that you have a clear path to success. An effective business plan can make you stand out and increase your chances of getting funded. Adding financial projections will help too.

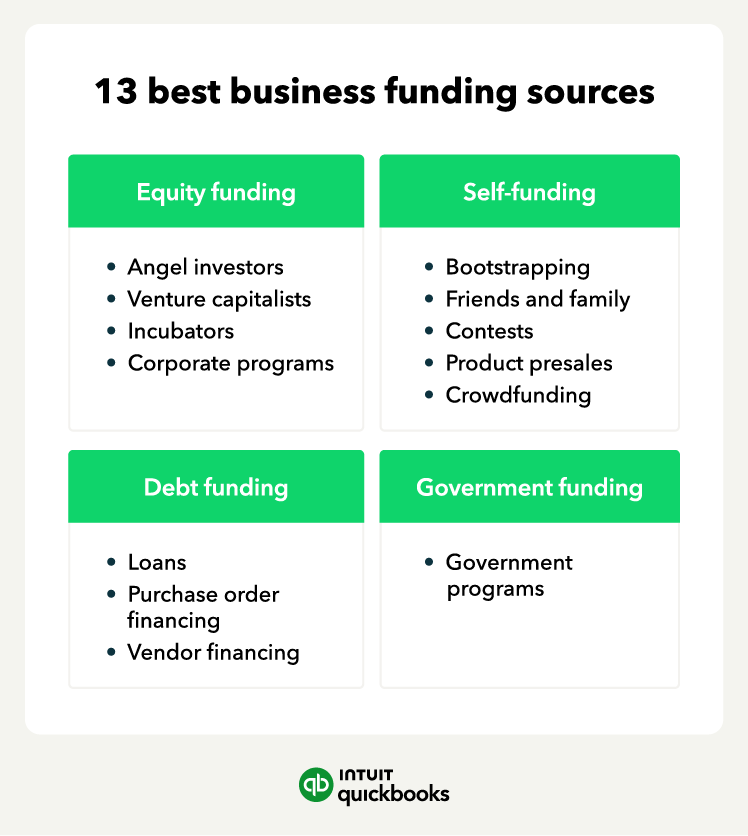

There are several funding options available for online businesses. Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise small amounts of money from a large number of people. Here are a few options:

- Crowdfunding

- Angel Investors

- Venture Capital

- Small Business Loans

If you’re considering loans, there are also many small business loan options. Banks and online lenders often offer loans specifically tailored for online startups. Make sure to compare different loan products to find the best terms and rates. Additionally, some government programs provide loan guarantees to make it easier for online businesses to get credit. Always read the fine print before signing any loan agreements.

Step 1: Determine your funding needs

Before diving into various funding options, it’s crucial to know exactly how much money you need. Start by listing all anticipated expenses, such as website development, marketing, and inventory. Make sure every detail is accounted for to avoid unexpected surprises. Break down costs in a simple format to give you a realistic picture. Identifying these needs will guide you in selecting the right type of funding.

While creating your cost list, it might be helpful to categorize expenses. Categorizing will make it easier to see where most of your funds will go. Common categories include:

- Technology and software

- Marketing and advertising

- Product development

- Operating expenses

Next, think about any potential hidden costs. Hidden costs can include transaction fees, shipping, and customer service. Some of these might seem small individually but can add up over time. Taking these into account is vital to create a comprehensive budget. Leaving out hidden costs might lead to seeking additional funding later.

Finally, evaluate if your business could flourish with different funding levels. Sometimes, starting small and scaling gradually is more sustainable. Organizing your data in a table might help visualize multiple scenarios. Here’s how it might look:

| Funding Level | Initial Costs | Projected Growth |

|---|---|---|

| Basic | $5,000 | 5% growth |

| Enhanced | $10,000 | 10% growth |

| Ambitious | $20,000 | 20% growth |

Step 2: Prepare a solid business plan

Creating a solid business plan is a crucial step when seeking funding. A well-thought-out plan shows investors you have a clear vision and strategy. Start with an executive summary that highlights your business idea and goals. This section should capture attention and make readers want to learn more. Keep the language simple but impactful.

A comprehensive business plan should include both market research and competitor analysis. Market research helps you understand your target audience and industry trends. Competitor analysis shows your understanding of the business landscape. It identifies your unique selling points and explains how you plan to stand out. Presenting these analyses can build confidence among potential investors.

The business plan is not complete without a detailed financial section. Highlight your expected income, expenses, and profit margins. You can present this data in a table for clarity:

| Year | Projected Revenue | Expected Expenses | Profit Margin |

|---|---|---|---|

| Year 1 | $50,000 | $30,000 | $20,000 |

| Year 2 | $80,000 | $50,000 | $30,000 |

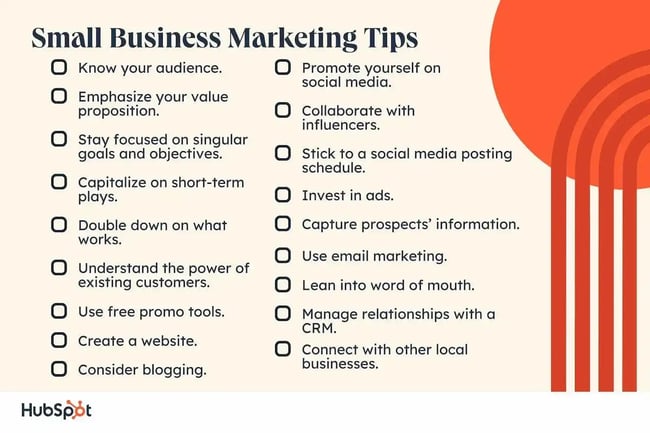

Your business plan should also outline your marketing and operational strategies. Consider how you will reach your customers and maintain efficient operations. A solid marketing strategy can include social media, email campaigns, and partnerships. The operational plan should describe your daily activities and how you will manage them. Together, these sections provide a roadmap for launching and growing your business.

Step 3: Explore crowdfunding platforms

Venturing into crowdfunding can open doors to numerous opportunities for your online business. Crowdfunding allows you to raise small amounts of money from many people. It not only offers a financial boost but also helps build a community of supporters. Take the time to research the best platform that suits your business type. Make sure to read the rules and fees before deciding.

Different crowdfunding platforms serve various purposes and niches. Some well-known platforms include Kickstarter, Indiegogo, and GoFundMe. Kickstarter is great for creative projects, while Indiegogo offers more flexibility. GoFundMe is often used for personal and charitable causes. Match your project with the right platform to increase your chances of success.

A successful crowdfunding campaign relies heavily on a captivating pitch. Your pitch should clearly communicate your business idea and why it matters. Include catchy visuals and engaging stories to capture attention. Many successful campaigns use short videos to introduce their project. Make sure to highlight what sets your idea apart from others.

Incentives are a significant part of crowdfunding campaigns. Offering rewards to backers can motivate more people to contribute. Here’s a simple way to structure incentives:

- $10- Supporter: A thank you note

- $25- Backer: Early access to product

- $50- Partner: A limited edition item

Once your campaign is live, promoting it is crucial. Share your crowdfunding page through social media and email newsletters. Engage with your supporters and keep them updated on your progress. The more people know about your campaign, the higher the chances of reaching your goal. Effective communication can turn your supporters into long-term backers.

Step 4: Reach out to investors

Connecting with investors is an important step in securing funding for your online business. Start by identifying the types of investors who align with your business goals. These could be angel investors, venture capitalists, or seed investors. Each offers different levels of support and might have varying levels of involvement. Knowing who suits your needs best is crucial.

Your pitch is a pivotal part of reaching out to investors. It should concisely explain what your business does and why it’s valuable. Prepare a short, engaging presentation to capture attention quickly. Highlight key points like market potential, your management team’s expertise, and financial forecasts. Rehearse your presentation to ensure you deliver it confidently.

It’s also critical to establish a personal connection with potential investors. Network by attending industry conferences, webinars, and local business events. LinkedIn can also be a helpful tool to connect with investors directly. Engagement in these circles increases your chances of meeting someone interested in your venture. Don’t shy away from sharing your passion and excitement.

When you’re ready to meet, have supporting materials ready. This includes your business plan, product prototypes, and market analysis. You can use a table for financial projections to provide clear insights into expected growth:

| Year | Revenue | Expenses | Net Profit |

|---|---|---|---|

| 1 | $60,000 | $40,000 | $20,000 |

| 2 | $100,000 | $70,000 | $30,000 |

Finally, follow up after your meetings to express gratitude and keep the dialogue open. A thank you email goes a long way in making a positive impression. It shows that you value their time and are interested in their partnership. Continuing the conversation may lead to future opportunities, even if they don’t invest right away. Patience and perseverance are key to building strong investor relationships.

Step 5: Consider small business loans

Small business loans can be an excellent option if you’re looking to fund your online business. These loans offer a way to cover startup costs without giving away equity in your company. Banks, credit unions, and online lenders are common places to apply for these loans. Understanding the different options can help you find a loan with favorable terms. Exploring multiple lenders will give you more choices.

Before applying for a loan, gather all necessary documents. This typically includes a detailed business plan, financial statements, and tax returns. Organizing this paperwork in advance can speed up the application process. Also, check your credit score, as it plays a significant role in approval. A higher score often leads to better loan terms.

Small business loans usually come in different types. Key options include term loans, business lines of credit, and equipment financing. Each type of loan serves different business needs, such as purchasing inventory or upgrading technology. Choosing the right type of loan largely depends on your specific requirements. Here’s a brief overview:

- Term Loans: Ideal for one-time funds for growth or significant expenses.

- Business Lines of Credit: Offers flexibility for ongoing expenses.

- Equipment Financing: Used for buying business-related equipment.

Once you’ve decided on a loan, you’ll need to compare interest rates. Different lenders offer varying interest rates based on creditworthiness and loan type. The interest rate impacts the overall cost of the loan. Make sure to understand all fees associated with the loan. Reading the fine print can prevent unexpected costs down the line.

Finally, be prepared to negotiate the terms of your loan. Some lenders may be open to discussions about interest rates or repayment schedules. Negotiating can lead to more favorable conditions for your business. Remember to ask questions to ensure you fully understand the agreement. A fair deal can help your online business thrive while maintaining financial stability.

Advantages of crowdfunding for online business

Crowdfunding is a powerful tool for funding online businesses, offering several distinct advantages. One major benefit is that it provides access to capital without the need for traditional loans or investors. This democratizes the process, making it easier for anyone with a great idea to get started. Crowdfunding platforms like Kickstarter and Indiegogo help turn concepts into reality. They allow entrepreneurs to pitch directly to the public.

Another significant advantage is the marketing exposure crowdfunding provides. When you launch a campaign, your business idea reaches thousands of potential backers and customers. This immediate visibility boosts brand awareness and helps grow your audience even before your product hits the market. The excitement generated by an active campaign can increase demand and accelerate growth. It’s a fantastic way to engage people early.

Crowdfunding also serves as a valuable validation tool for businesses. If people are willing to invest in your idea, it suggests that there’s interest and viability in the market. This feedback can help you fine-tune your product before its official launch. Additionally, collecting feedback from backers may lead to improvements or innovation in your offerings. Here’s how it benefits:

- Market testing through real customer interest

- Opportunities for product refinement

- Increased credibility with future investors

The flexibility of crowdfunding campaigns is another plus point. Entrepreneurs can set their funding goals, deadlines, and unique incentives for backers all within one platform. This control over campaign parameters means you have more say in how funds are raised and used later on. Flexibility also extends to rewards structure—offering products, merchandise, or exclusive content based on different contribution levels can attract more support.

Lastly, successful crowdfunding campaigns often strengthen community connections around a brand or product. Supporters feel invested not only financially but emotionally as part of something they helped create from scratch—the Thank You notes sent out after achieving goals serve much greater purposes than appreciation alone! These communities frequently become loyal evangelists who spread word-of-mouth recommendations about brands they believe using firsthand experiences shared during collaborative development phases made possible unlike anything else available today thanks only newfound perspectives gained via interactivity inherent venue chosen utilize crowdfund raises upon broader scales worldwide presently imaginable previously unimaginable results now coincide seamlessly therein provided mutual endeavors engaging multifaceted awesomeness surpassed expectations collectively imagined exceeded ideals forged synergy defining modern CROWDFUND defined greatness revealed glory attained.

Guide to approach investors for online business funding

Approaching investors can seem intimidating, but it’s a crucial step for funding your online business. Begin by doing thorough research on potential investors who align with your business objectives. Choose those who have a history of investing in companies similar to yours. Understanding their investment criteria will help tailor your pitch. The goal is to find a good match that benefits both parties.

Your pitch plays a pivotal role in securing investor interest. Focus on crafting a compelling presentation that tells the story of your business. Emphasize the unique aspects of your product and how it stands out in the market. Keep your presentation concise yet informative, covering key points like market opportunities and financial projections. Practicing your pitch increases your confidence and effectiveness.

Building a genuine connection with investors is vital for successful engagement. Networking events, startup meetups, and online platforms like LinkedIn provide opportunities to establish initial contact. Cultivate relationships by showing genuine interest in the investor’s portfolio and past successes. A strong rapport can significantly influence their decision to invest. Authenticity and trust are significant aspects of these relationships.

When meeting potential investors, be prepared to provide comprehensive supporting materials. These should include your business plan, market analysis, and financial statements. Providing clear and structured information can enhance your credibility. Consider using a table to organize your financial data:

| Year | Projected Revenue | Operating Costs | Profit Margin |

|---|---|---|---|

| 1 | $75,000 | $50,000 | $25,000 |

| 2 | $110,000 | $65,000 | $45,000 |

Follow-up communication is key after any investor meeting. Send a thank you email expressing your appreciation for their time and consideration. This gesture reinforces your professionalism and keeps the conversation open. Providing additional information or updates about your business can keep them engaged. Consistent communication maintains interest and builds lasting relationships with potential backers.

Role of a robust business plan in funding proposal

A strong business plan is crucial when you’re seeking funding for your online business. It lays the foundation for what your business aims to achieve and how it plans to get there. Investors often look for this document to understand your vision and strategies clearly. It outlines everything from your goals to the practical steps in reaching them. This clarity helps reassure investors about the potential success of your venture.

One core component of a business plan is market research. Knowing your target audience and competitors demonstrates that you’ve done your homework. This section explains why there’s a demand for your product and how you’ll capture market share. Convincing investors requires illustrating that there’s a viable path to growth. Having solid data to back up your claims is vital.

The financial projections in your business plan are key for gaining investor trust. This part of the plan predicts future income, expenses, and profits. Here’s a simple format you might use:

| Year | Income | Expenses | Net Profit |

|---|---|---|---|

| 1 | $80,000 | $55,000 | $25,000 |

| 2 | $130,000 | $70,000 | $60,000 |

A well-rounded business plan also includes your marketing and operational strategies. You’ll want to show how you plan to attract and retain customers. Describe the day-to-day operations that will drive success. Highlighting these strategies shows investors that you’re prepared for the practical challenges of running your business. A solid plan reflects strong leadership and foresight.

A detailed business plan is not just for potential investors; it’s also a tool for you. It guides your decision-making process and helps focus your efforts. As your business grows, your plan acts as a roadmap, helping you stay aligned with your original vision. By following this plan, you can measure progress and make adjustments as needed. It keeps you on track, ensuring the successful execution of your business goals.

Tips to secure a small business loan for online business

Securing a small business loan can be a vital step for your online business’s growth. One of the first things to do is check your credit score. Lenders often base loan approvals on your credit history. A good score can lead to more favorable terms and lower interest rates. Knowing where you stand helps you prepare better.

Another key aspect is preparing thorough documentation. This includes a solid business plan, financial statements, and tax returns. A well-prepared set of documents shows lenders that you’ve planned meticulously. Organizing these materials in advance not only saves time but also builds confidence. Proper preparation demonstrates your responsibility and readiness for a loan.

Researching multiple lenders can open up various opportunities. Different lenders offer unique loan products that might suit your business needs better. Compare their terms, interest rates, and repayment plans. Some online lenders might offer more flexible terms than traditional banks. Here’s a quick comparison you might do:

| Lender | Interest Rate | Repayment Term |

|---|---|---|

| Online Lender A | 6% | 5 years |

| Bank B | 8% | 3 years |

Don’t hesitate to negotiate the loan terms with your lender. Sometimes, lenders might be open to customizing interest rates or repayment schedules. Negotiation can result in terms that are more beneficial for your business. Always clarify any doubts and make sure you fully understand the agreement. Clear communication helps create a win-win situation for both parties.

Finally, consider seeking expert advice if needed. Financial advisors or mentors can provide valuable insights and guidance. They can help you understand complex loan terms or suggest alternative funding methods. Their experience might help you avoid common pitfalls in the loan process. Having expert support can ease your loan journey and ensure your business thrives with new-found capital.

Final Thoughts on Securing Funds for Your Online Business

Securing funding for your online business is a crucial step toward growth and success. Whether you decide to use crowdfunding, seek investor partnerships, or apply for small business loans, preparation is key. Each option offers unique benefits and requires thorough research and planning to maximize potential.

A solid business plan and clear financial projections can make a significant impact on potential funders. By establishing strong connections and communicating effectively, you enhance investor confidence. Above all, remain flexible and persistent in your journey to secure the necessary resources for your entrepreneurial vision.