Financial Planning Careers Explained: Navigating Your Path to Success

Financial planning is a dynamic and essential field, offering a range of career opportunities for individuals passionate about helping others achieve their financial goals. Whether you’re considering a career in personal finance or corporate financial management, understanding the various financial planning roles is crucial. This article provides a comprehensive overview of financial planning careers, what they entail, and the steps you need to take to succeed in this rewarding industry.

What Is Financial Planning and Why Is It Important?

Financial planning involves assessing and managing an individual’s or organization’s financial situation to ensure that they can meet their long-term financial goals. It includes budgeting, investing, saving, and managing risks. Financial planners help clients make informed decisions regarding their finances, offering advice on everything from retirement planning to tax strategies.

The importance of financial planning cannot be overstated. With proper planning, individuals and businesses can achieve financial stability, mitigate risks, and prepare for the future. This is why financial planning careers are in high demand and offer significant opportunities for growth.

Types of Financial Planning Careers

The financial planning industry is diverse, with numerous career paths depending on your interests and skills. Some of the most common roles in financial planning include:

Financial Advisor: Financial advisors work with individuals to help them achieve their personal financial goals. They provide services such as retirement planning, investment advice, and estate planning.

Wealth Manager: Wealth managers offer high-net-worth individuals personalized financial services, including investment strategies, tax planning, and portfolio management.

Certified Financial Planner (CFP): A CFP is a specialized financial advisor who has completed the certification process and adheres to ethical standards. They are qualified to provide comprehensive financial planning services.

Corporate Financial Planner: Corporate financial planners focus on helping businesses manage their finances, including budgeting, financial analysis, and forecasting.

Each of these roles requires a unique set of skills, ranging from financial analysis and tax planning to interpersonal communication and customer service.

Key Skills for a Successful Financial Planning Career

To excel in the financial planning field, professionals need to develop a range of skills. Here are some of the key skills that can help you succeed:

Analytical Skills: Financial planners must be able to analyze data, understand market trends, and make informed decisions based on financial information.

Communication Skills: Since financial planning often involves working closely with clients, strong communication skills are essential. Being able to explain complex financial concepts in simple terms is crucial.

Problem-Solving Abilities: Financial planners need to identify issues and offer practical solutions tailored to the unique needs of their clients.

Attention to Detail: Precision is key when handling financial documents, investments, and strategies. Small errors can lead to significant financial losses.

Ethical Judgment: Financial planners are trusted with sensitive financial information, so adhering to ethical standards is vital in this field.

How to Start a Career in Financial Planning

If you’re interested in pursuing a financial planning career, there are several steps you can take to get started:

1. Get an Education: A bachelor’s degree in finance, economics, accounting, or a related field is typically required for most financial planning roles.

2. Gain Relevant Experience: Many entry-level financial planning jobs, such as a financial analyst or associate advisor, provide valuable experience that can help you advance in your career.

3. Obtain Certifications: To stand out in the field, pursuing certifications such as the Certified Financial Planner (CFP) designation can open doors to higher-paying opportunities and specialized roles.

4. Build a Network: Networking is key to finding job opportunities and staying informed about industry trends. Joining professional organizations like the Financial Planning Association (FPA) can help you connect with others in the industry.

5. Stay Current: The financial industry is constantly evolving. Staying up-to-date with the latest trends, tax laws, and financial products will give you an edge in this competitive field.

The Benefits and Challenges of Financial Planning Careers

A career in financial planning offers several benefits, including:

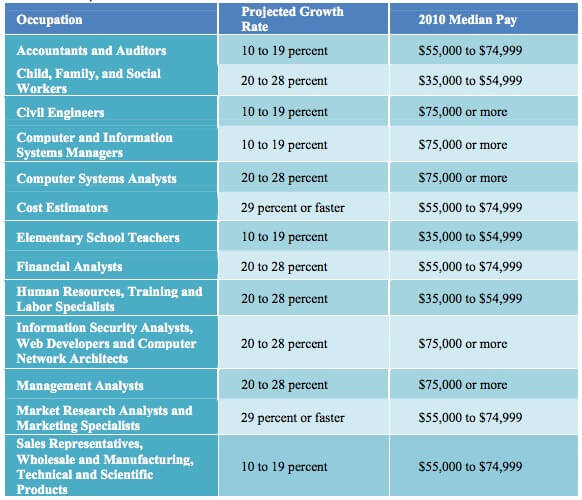

Lucrative Earning Potential: Financial planners can earn significant salaries, particularly with experience and specialized certifications. Wealth managers, in particular, can earn substantial bonuses and commissions.

Job Security: As long as there are individuals and businesses seeking to manage their finances, there will be a demand for financial planners.

Flexibility: Many financial planners have the option to work independently or in a firm, providing flexibility in terms of work style and work-life balance.

However, there are also challenges to consider:

High Pressure: Financial planners are often responsible for making decisions that directly affect their clients’ financial well-being, which can be stressful.

Continuous Education: The financial industry evolves quickly, requiring professionals to continuously update their knowledge and certifications.

Client Acquisition: Building a client base can be challenging, particularly for those who are just starting in the field.

Frequently Asked Questions (FAQ)

Q1: What qualifications are required to become a financial planner?

A1: A bachelor’s degree in finance, accounting, or economics is typically required, along with certifications such as the CFP (Certified Financial Planner) for specialized roles.

Q2: How much can I earn as a financial planner?

A2: Salaries for financial planners vary depending on experience, location, and specialization. On average, a financial planner earns between $60,000 to $100,000 annually, with higher salaries for wealth managers and those with certifications.

Q3: Can I work as a freelance financial planner?

A3: Yes, many financial planners work independently or as freelancers, providing personalized financial advice to individuals and businesses.

Q4: How long does it take to become a certified financial planner?

A4: Becoming a CFP typically takes around 3 to 5 years, including educational requirements and passing the certification exam.

Q5: What is the job outlook for financial planners?

A5: The job outlook for financial planners is positive, with a projected growth rate of 4% from 2020 to 2030, driven by an aging population and an increasing need for retirement and investment planning.