Best Business Bank Accounts for LLC: Find the Right Fit for Financial Growth

Opening the right business bank account is one of the first and most important steps for any Limited Liability Company (LLC). It separates personal and business finances, simplifies accounting, boosts your credibility, and sets the foundation for long-term financial management. But not all bank accounts are built the same. The best business bank accounts for LLCs combine low fees, robust digital tools, scalability, and customer support that matches your company’s growth stage. Whether you’re launching a brand-new startup or scaling an established LLC, the right account can help streamline your finances and empower smarter decision-making.

Why LLCs Need a Dedicated Business Bank Account

LLCs are legal entities, meaning your business finances must be separated from personal assets to maintain liability protection. Using a personal account for business transactions can blur those lines and risk legal exposure. A business checking account not only keeps your books clean but also helps when filing taxes, applying for loans, or tracking cash flow. Many banks now offer LLC-specific features like multi-user access, integrated invoicing, expense categorization, and API connectivity for accounting platforms. The best options support compliance while saving you time and giving you the financial clarity every business owner needs.

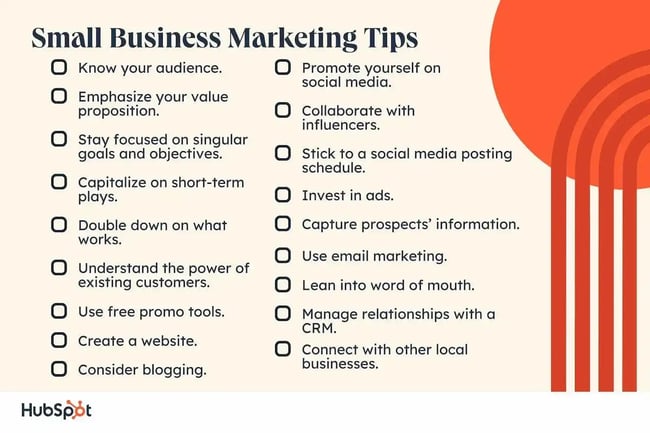

What to Look for in a Business Bank Account for Your LLC

Every LLC has different needs, but some features matter across the board. Look for accounts with no monthly maintenance fees or ones that waive them based on minimum balances or transaction activity. Consider how many monthly deposits, ACH transfers, and wire transactions are included, and whether you’ll need access to physical branches or prefer fully digital operations. Mobile apps with strong user reviews, instant transaction notifications, and easy integrations with tools like QuickBooks, Stripe, or Gusto are also key. FDIC insurance, fraud protection, and responsive customer support are essential for protecting your funds and peace of mind.

Top-Rated Business Bank Accounts for LLCs

Some banks stand out consistently among LLC owners for their convenience, value, and features. Novo is a top choice for digital-first businesses, offering fee-free banking with strong integrations and quick account setup. Bluevine is praised for its high-interest checking and easy access to lines of credit. Mercury is designed for tech startups and remote teams, offering sleek UX and advanced automation. For those preferring traditional banks, Chase Business Complete Banking™ offers strong branch access and rewards. Bank of America and Wells Fargo also provide scalable business solutions, especially for LLCs expecting steady cash flow or in-person banking needs.

Mistakes to Avoid When Opening a Business Account for Your LLC

One common mistake is choosing a bank without considering how your business will operate in the next 12 to 24 months. Many entrepreneurs outgrow basic accounts quickly if they don’t plan for transaction volume, team growth, or financing needs. Another pitfall is failing to compare hidden fees charges for wires, overdrafts, or deposits can add up fast. Some LLC owners also open accounts without proper documentation, leading to frustrating delays. Before applying, make sure your LLC is officially registered and that you have your EIN, formation documents, and operating agreement ready to streamline approval.

Digital-Only vs. Traditional Banks: What’s Better for Your LLC?

Choosing between online banks and traditional institutions comes down to how you manage your operations. Digital banks tend to be more flexible, faster to set up, and packed with tech features perfect for eCommerce, freelancers, and SaaS startups. They often have fewer fees and better online dashboards. However, traditional banks offer in-person support, cash deposit options, and a wider range of financial services like business loans, credit lines, and merchant services. Many LLCs benefit from hybrid solutions starting with a digital account for daily operations and adding a traditional account for lending or long-term financial planning.

FAQs About Best Business Bank Accounts for LLCs

Do I need an EIN to open a business bank account for my LLC?

Yes. Most banks require an Employer Identification Number (EIN) for LLC accounts to comply with tax and legal regulations.

Can I open a business account online for my LLC?

Absolutely. Many banks now offer full online application processes—especially digital-first banks like Novo, Mercury, or Bluevine.

Is it better to use a local bank or national bank for my LLC?

It depends on your needs. Local banks may offer personalized service, while national banks offer scale, tools, and integrations.

Are there any business bank accounts with no monthly fees?

Yes. Several banks offer fee-free business checking, especially online-only platforms or banks with minimum balance waivers.

What documents are required to open a business account for an LLC?

Typically, you’ll need your EIN, LLC formation documents, operating agreement, and a valid government-issued ID.