Investment Property for Sale: A Smart Move for Financial Growth

Are you searching for an investment property for sale that brings passive income, long-term capital appreciation, or portfolio diversification? You’re not alone. Property investment has long been a cornerstone of wealth building, and in today’s data-driven world, smart investors use deep learning tools and market insights to make informed decisions. Whether you’re a seasoned buyer or stepping into the world of real estate for the first time, understanding what makes a property worth investing in is critical. This guide is designed for savvy investors, real estate professionals, and anyone looking to turn bricks and mortar into financial momentum. With the rise of AI-driven valuation and location analytics, finding the right property has never been more strategic.

How to Spot the Perfect Investment Property in Any Market

Finding an investment property for sale isn’t just about location anymore. Today, successful buyers analyze rental yield, neighborhood demand, and future appreciation potential using predictive tools. A good investment property is typically situated in a growth corridor with expanding infrastructure, low vacancy rates, and strong tenant demand. These properties also offer a balance between affordability and income generation. Think beyond aesthetics—focus on the numbers, long-term returns, and exit strategy. In markets where prices are rising rapidly, such as certain parts of Texas, Florida, or even overseas cities like Lisbon, a well-timed purchase can deliver strong ROI with relatively low maintenance.

Deep Learning is Shaping the Future of Real Estate Investing

Gone are the days of relying solely on gut feeling or an agent’s advice. Investors now use AI models trained on thousands of real estate transactions to evaluate risk, forecast cash flow, and even predict gentrification trends. Platforms powered by deep learning can analyze local crime rates, school rankings, and rental income trends in seconds. These insights help buyers identify undervalued homes and emerging hotspots. From determining when to buy to estimating optimal rent, AI tools enable sharper decisions. So if you’re looking at a particular investment property for sale, plug the data into a predictive model before committing. It could save you thousands or earn you much more.

What Makes an Investment Property Truly Profitable?

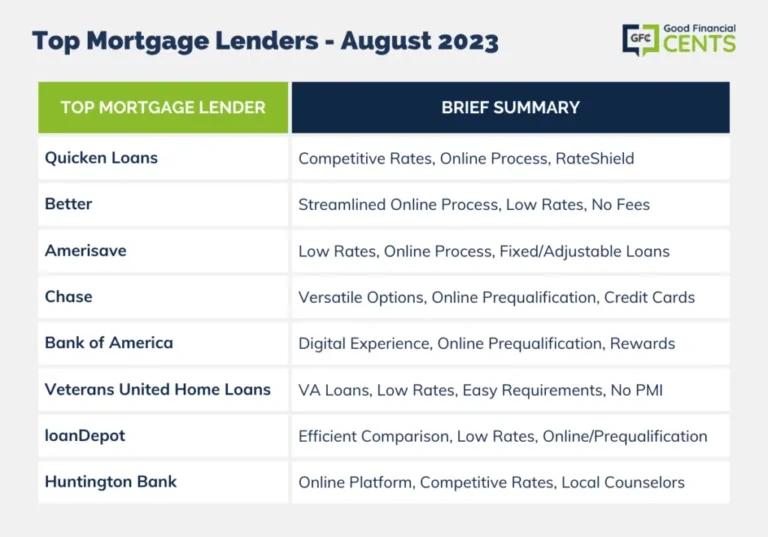

A profitable investment property isn’t just about purchase price. It’s about how well it performs over time. Key profitability indicators include net operating income, cap rate, cash-on-cash return, and appreciation rate. To succeed, choose properties with strong rental appeal—near transport hubs, business districts, or universities. Also, consider the tax structure and whether the property qualifies for any depreciation benefits. In today’s competitive market, even small differences in mortgage rates or property taxes can significantly impact your bottom line. If the investment property for sale you’re eyeing doesn’t meet your desired cash flow or resale benchmarks, keep looking. The right deal is out there.

Hidden Pitfalls to Avoid When Buying Investment Property

Every property comes with risk, and not all deals labeled as “investment-grade” actually deliver results. Overpriced properties, hidden renovation costs, or tenant turnover issues can erode profits. Many first-time investors overlook due diligence—failing to inspect structural issues or ignoring local rental laws. Another red flag is buying in an area with declining population or job growth. Even if the price seems right, it could be a trap. Don’t rely solely on glossy listings. Always conduct financial analysis, talk to local property managers, and run ROI scenarios. A seemingly perfect investment property for sale may not stack up under scrutiny.

Where to Find the Best Investment Property Deals Today

Online marketplaces, foreclosure listings, wholesaler networks, and auction platforms are rich sources of real estate deals. But timing is everything. The best opportunities often never reach public listings—they’re snapped up through off-market channels, direct seller outreach, or investment groups. Use smart alerts and AI property finders to stay ahead of the curve. Sites like Roofstock, LoopNet, and Realtor.com now integrate machine learning to recommend properties that match your investment criteria. If you’re serious, get pre-approved and be ready to act fast. The more efficiently you filter for ROI-positive properties, the quicker you’ll find that ideal investment property for sale.

FAQs

What is the best type of investment property for beginners?

Single-family homes in stable neighborhoods are often recommended due to lower risk and ease of management.

How do I calculate ROI on an investment property?

Subtract annual expenses from rental income, then divide by your total investment to get your return on investment.

Are investment properties still profitable in 2025?

Yes, especially in emerging markets and with smart use of AI tools to identify underpriced assets.

Is it better to buy or finance an investment property?

Financing can increase ROI through leverage, but cash purchases offer simplicity and less risk.

How can I find off-market investment properties?

Network with realtors, join investor groups, or use data-driven tools that source seller leads directly.