Emergency Finance Planning for Families: Protect Your Loved Ones and Your Future

Emergencies are unpredictable, and they can happen at any time, often leaving families in a state of financial uncertainty. Whether it’s an unexpected job loss, a medical emergency, or natural disasters, having an emergency finance plan in place can make a significant difference in how well your family can weather these storms. Emergency finance planning for families helps you build a safety net, ensuring that you can cover unexpected costs without depleting your savings or going into debt. In this article, we will explore the importance of emergency finance planning and provide actionable steps that families can take to prepare for life’s unexpected events.

Why Emergency Finance Planning Is Crucial for Families

Life is full of surprises, and not all of them are positive. Financial emergencies can put tremendous stress on families, both emotionally and financially. With proper planning, however, families can mitigate the impact of unexpected events, ensuring they have the resources to cover immediate expenses and maintain stability. Emergency finance planning not only provides a financial cushion but also reduces the risk of falling into debt or experiencing financial hardship during times of crisis. Whether you are looking to safeguard your family’s future or are preparing for potential challenges, emergency finance planning is essential for peace of mind.

Building an Emergency Fund: The Foundation of Your Financial Safety Net

One of the most critical aspects of emergency finance planning is creating an emergency fund. An emergency fund is a dedicated savings account designed to cover unforeseen expenses, such as medical bills, car repairs, or sudden job loss. Experts recommend saving enough to cover at least three to six months’ worth of living expenses in case of an emergency. Start by setting small, achievable goals and gradually building up your emergency savings. Automating deposits into your emergency fund is an effective strategy to ensure that you consistently contribute, even when life gets busy.

Understanding Insurance Coverage: A Key Component of Emergency Planning

Insurance is a vital part of any emergency finance plan. It helps protect your family against significant financial loss due to accidents, health issues, or property damage. Health insurance, life insurance, auto insurance, and homeowner’s insurance are just a few examples of coverage that can make a big difference in a time of crisis. Review your insurance policies regularly to ensure they provide adequate protection for your family. If necessary, update your coverage to reflect any changes in your lifestyle, such as purchasing a new home or having a baby.

Reducing Debt: A Strategic Step for Financial Preparedness

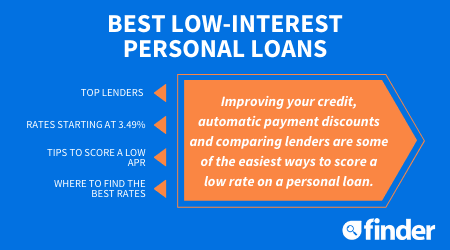

High levels of debt can make it difficult for families to recover from financial emergencies. Reducing outstanding debt should be a priority when creating an emergency finance plan. Start by paying down high-interest debt, such as credit card balances, to reduce your monthly expenses. Consider consolidating or refinancing loans to secure lower interest rates. By reducing debt, you free up more resources that can be used to address unforeseen costs. Additionally, maintaining a healthy credit score can help you secure loans or credit in the event of an emergency without incurring exorbitant interest rates.

Establishing Financial Priorities and a Crisis Budget

During an emergency, it’s essential to prioritize essential expenses and create a crisis budget. This budget should focus on the most critical needs, such as food, shelter, healthcare, and transportation. Review your family’s spending habits and identify areas where you can cut back in case of a financial emergency. Temporarily reducing non-essential expenses, such as dining out or entertainment, can help conserve cash during a crisis. Having a clear financial priority plan in place ensures that you and your family can maintain stability and meet immediate needs until the emergency passes.

FAQs

- What is an emergency finance plan for families? It’s a strategy to prepare for unexpected financial challenges by building savings, securing insurance, reducing debt, and budgeting for emergencies.

- How much should I have in my emergency fund? Aim for three to six months’ worth of living expenses to cover essential costs in case of job loss, medical emergencies, or other unexpected events.

- What types of insurance should I have for emergency finance planning? Key types of insurance include health, life, auto, and homeowner’s or renter’s insurance. These help protect against large, unforeseen expenses.

- How can I reduce debt as part of emergency finance planning? Focus on paying down high-interest debts first and consider consolidating loans or refinancing to lower monthly payments and interest rates.

- How do I create a crisis budget? A crisis budget focuses on essential expenses like food, housing, healthcare, and transportation. Cut back on non-essential expenses to save money during an emergency.